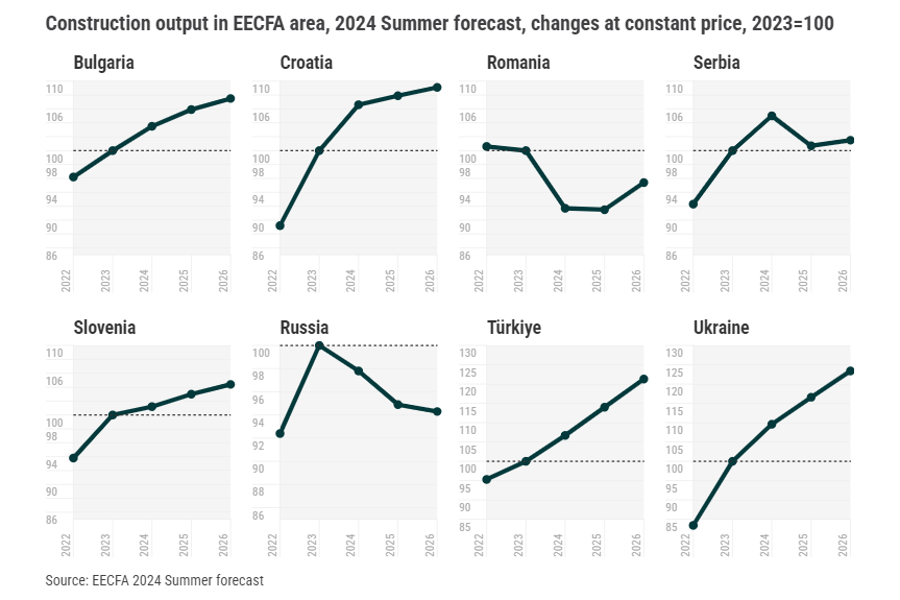

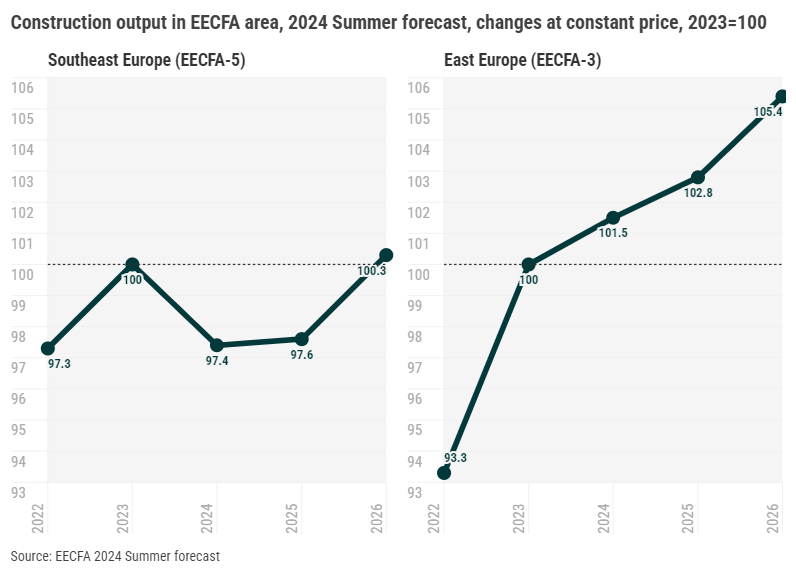

As per the 2024 Summer construction forecast of EECFA, the Eastern European Construction Forecasting Association, released on 25 June, the expansion phase was over in 2023 in the Southeast European (SEE) region as a whole, but the current contraction is not foreseen to last as long as the latest one after 2008. By 2026 this region could return to around its previous peak. The Eastern European (EE) region as a whole is expanding, and EECFA is still optimistic all the way on the horizon. A closer look at the forecast reveals that only Romania, the largest market, is behind the overall setback of the SEE region. Here the previous peak is not expected to be reached soon. Elsewhere in the region further expansion is EECFA’s current view.

Serbia’s trajectory is a bit different, but the market could stay at a high level despite the drop next year. Recovery in Türkiye is forecast to be so strong that it could well counterbalance a shrinking Russia. Ukraine is coming back from a very low level, hence the relatively good growth figures.

Southeast European construction outlook up to 2026

Bulgaria's economy is set to grow by almost 2% in 2024 and 3% in 2025, while the country is heading to a eurozone membership, most likely in 2026. In parallel, construction output is forecasted to decline year on year in 2024-2026 due to expected drop in residential

construction and heterogeneous, yet positive performance of the non-residential one. Civil engineering bears a potential for an accelerated growth if EU funds’ absorption bounces back and public investments in infrastructure speed up.

Croatian civil engineering is moving into even higher gear now, especially with the recent update to the TEN-T Network, which greatly benefited Croatia. Accordingly, output in most civil engineering sectors will rise. Building output presents a more mixed picture, with some sectors having reached or come close to peak output, while others are thriving.

The outlook for Romania's construction sector remains negative this year. Inflation is shrinking, but more slowly than desired, keeping interest rates relatively high for longer and impacting financing costs. Also, the switch between the EU programming periods, combined with still high construction costs and an election year, will mean lower efficiency in starting and implementing long-term projects. Because the macroeconomic outlook is good and if the other issues are resolved, by 2026 construction might start growing again.

Serbia is expecting to see more stabilization in the construction sector this year, with both building construction and civil engineering estimated to stay in the black. The latter is very close to recording a consecutive double-digit growth in 2024. The economy is picking up, interest rates are slowly receding, so there is confidence that construction can sustain high output levels. Demand stays relatively strong, while stable prices are to keep investments high this year.

Slovenian construction is forecasted to surpass its record 2023 output this year and continue its growth trajectory into 2025, exceeding EUR 6 billion for the first time. Major civil engineering projects will likely drive this growth, bolstered by flood reconstruction efforts.

Public investment in housing is planned but is contingent on future public funding availability that will also impact non-residential construction. The industry faces workforce shortages, but increased immigration and declining construction costs are expected to mitigate these issues, supporting further growth.

Eastern European construction markets of EECFA up to 2026

In Russia, the increase in people’s solvency, the restoration of business activity and dynamic economic development ensured growth in construction output last year, but recovery trends are slowing down owing to both external restrictions and internal negative factors. The residential and civil engineering construction subsectors remain key for the industry, but their dynamics depend on the level of government participation and the volume of allocated budget funds. Even though negative trend is forecasted for the residential subsector in the coming years, the drop in overall construction output in 2024-2026 is not predicted to be significant as the market will be supported by the construction of export infrastructure projects.

Türkiye’s economy has been greatly affected by last year’s earthquakes that caused great human and material casualties, requiring the rebuilding of destroyed homes, workplaces, and infrastructure. The government’s costly obligations coincide with a return to conventional economic policies that require austerity. Massive reconstruction spendings have caused huge budget deficits and civil engineering is worst affected by this. Increased interest rates have created affordability problems for bank loans, mostly mortgage ones, so home

purchases rely mostly on equity financing and serve as a hedge against inflation. Home permits in Q1 2024 rose due to permits issued in earthquake-hit regions. This, followed by the private sector in most commercial building investments, aligns with high GDP growth.

Ukraine is making great progress in overcoming the consequences of the full-scale invasion, showing economic growth. The issue of reconstruction is acute, though. The main problems in the market are rising prices and shortage of building materials, growing costs of logistics and a shortage of skilled labour. In energy the immediate restoration of energy generation facilities is required to provide stable electricity. State and international programs for the restoration and construction of housing will likely contribute to the revival of the construction market. In the coming years, the future of the market, more than ever, will depend on three things: results on the battlefield; Ukraine's subjectivity in the international arena; and the ability to protect its interests against Russian diplomacy.