EECFA Press Release 2024 Winter

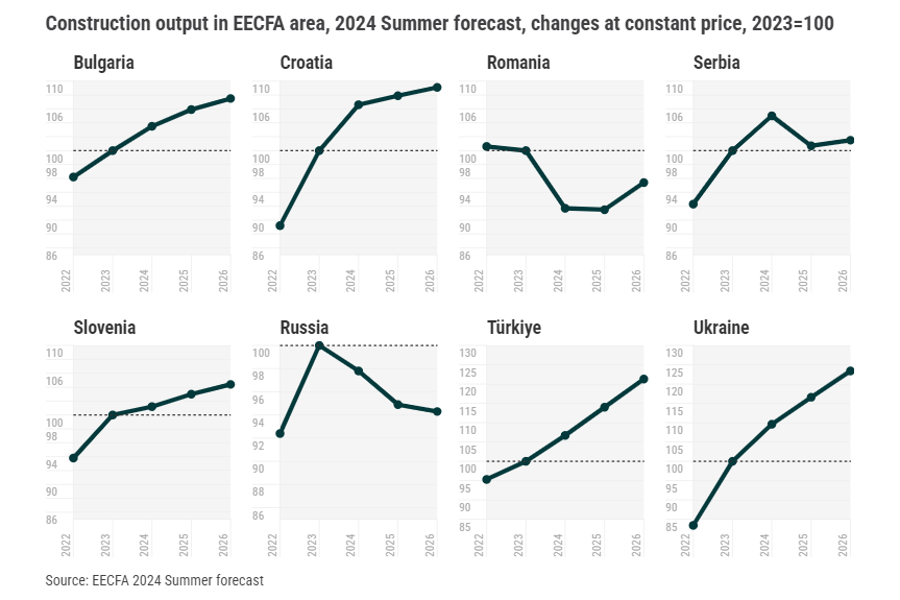

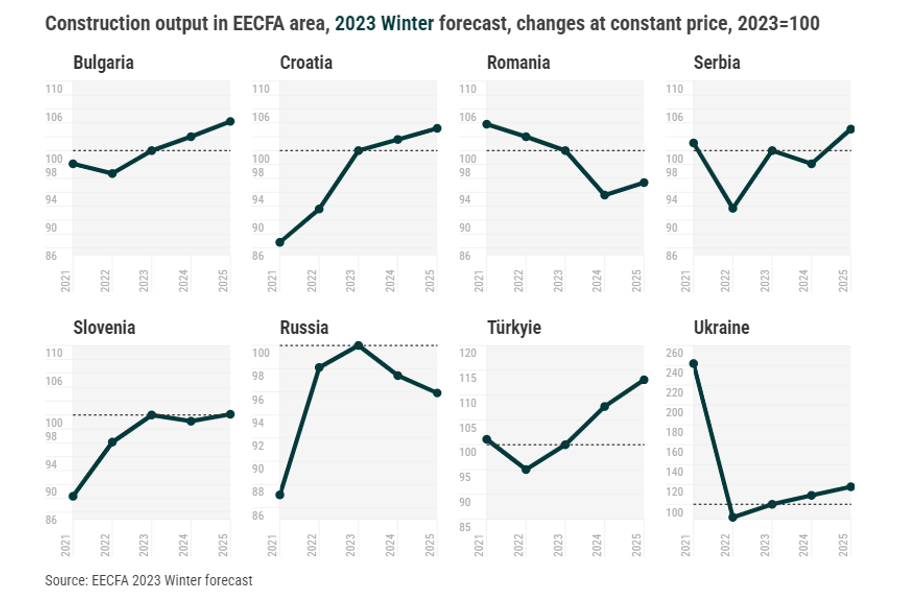

The 2024 Winter construction forecast of EECFA, the Eastern European Construction Forecasting Association, suggests that in the Eastern European region a more optimistic civil engineering outlook in Russia makes the overall picture even better than in the previous forecast round.

Eastern European construction markets

In the Eastern European region of EECFA, behind the quiet overall view in Russia, a massive drop is projected in the building construction market. Recovery in Türkiye could continue. We are optimistic in Ukraine too, but its market is still at historically low level.

In 2024, the Russian construction industry fared better than previously expected driven by the high pace of project implementation and the massive budget support in civil engineering and non-residential construction. It could even offset the negative impacts of the decline in housing construction caused by the end of the mass preferential mortgage program. However, this positive momentum is expected to gradually fade owing to the tight monetary policy of the Central Bank and several other internal and external factors that are slowing down the economy in general and the construction industry in particular. In 2025-2026, the record budget expenditures planned within the framework of new national projects and other measures of state financing will likely maintain construction market volumes in Russia in the positive territory, but with minimal growth.

In Türkiye, increased interest rates and the Central Bank’s policy to reduce the depreciation of the national currency to curb inflation has not yet produced the intended outcomes. And high interest rates are blamed for shrinking industrial output and decelerated trade growth. The interest rate and the Central Bank’s policies had two major effects on the construction sector: big negative real rates of change in construction costs and housing prices. Housing sales are growing as real prices drop and rely on equity financing since mortgage loans have become unaffordable at high interest rates. Building permits in most segments decreased in Q3 2024, while completions had a positive trend. The government’s legal obligation to rebuild the earthquake-damaged 350 thousand buildings with 870 thousand independent units has been the main factor in huge budget deficits that impede the Government from providing sufficient funds for civil engineering projects.

As a consequence of the war ongoing for over 1000 days, Ukraine’s construction market is facing economic difficulties, limited resources, huge losses in buildings, hike in building material prices, lack of skilled workers and limited access to financing, topped with the unpredictability of government decisions and the instability of property rights. The destroyed homes of more than 1.5 million families create a huge demand. Non-residential construction also focuses on the restoration of destroyed buildings and the construction of new ones in safer central and western regions. Civil engineering is also boosted by the renovation of bridges, roads, railways, pipelines, communication and power lines. The ‘Unified portfolio of public investment projects’ recently approved by the government includes 750 big reconstruction projects on roughly UAH 2.36 trillion, while the state budget also has UAH 256.1 billion for public projects in 2025. First, the EUR 50 billion under the EU’s Ukraine Facility are to be used. Financing is also planned through international financial organizations and foreign governments. The priority is energy, transport, utility and public buildings such as schools.

Source of data: EECFA Construction Forecast Report, 2024 Winter

If you would like to receive a sample report please use the following contact button or send an e-mail to sales@proidea.ro

EECFA's Southeast European Region: Bulgaria expected to see highest growth