EECFA Press Release 2024 Winter

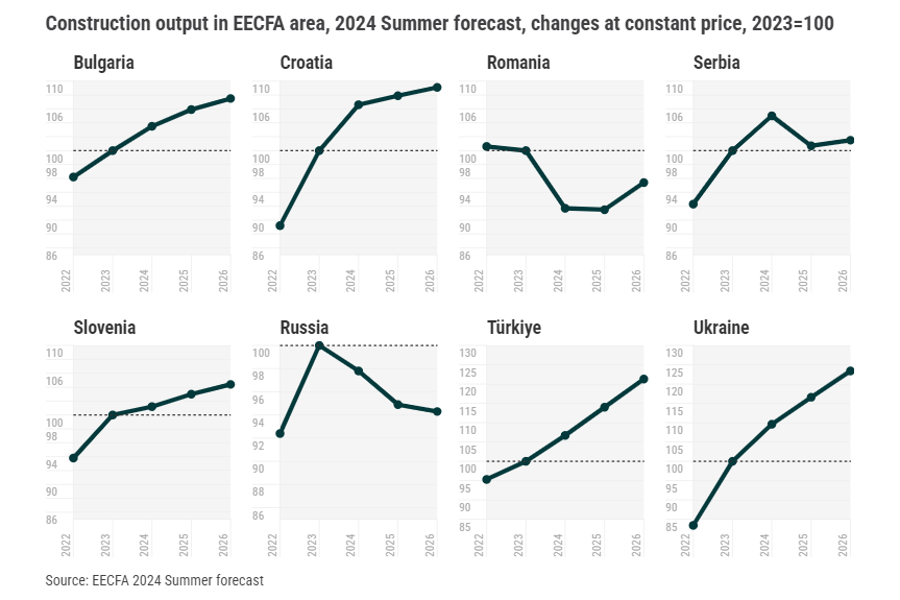

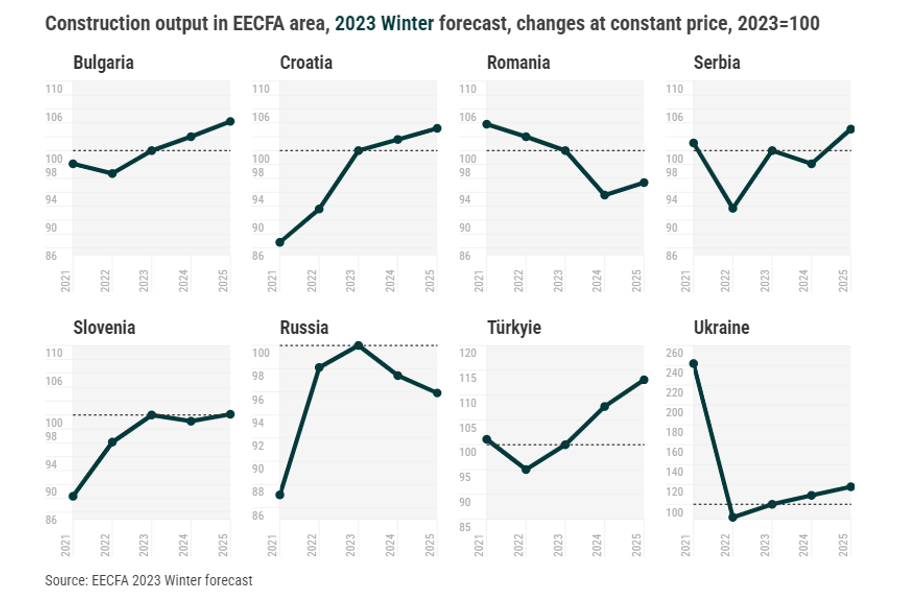

The 2024 Winter construction forecast of EECFA, the Eastern European Construction Forecasting Association, suggests that the Southeast European region is somewhat below the peak it reached in 2023 and is expected to stay around this level up to 2026. This level is not bad, though, the region combined has gone through a great expansion since 2016.

Southeast European construction markets

The biggest growth in this region of EECFA is foreseen in Bulgaria, the rest of the countries are projected to make side moves in the coming years. There are very different stories behind these side moves, though. For instance, in Serbia the non-residential submarket is expected to see further good growth over the horizon while civil engineering could decline.

Total construction output in Bulgaria is forecasted to grow by an average of 3.3% in 2024-2026, which is slightly above real GDP growth projections for the same period. The subsector breakdown shows that residential construction is expected to lose momentum, but this is likely to be compensated by a more dynamic performance of non-residential construction and civil engineering. In parallel, general economic activity in Bulgaria in the forecast period is to be influenced by the effects from the full membership in the Schengen area from 2025 onward and the prospects for the country to introduce the euro on 1 January 2026.

Croatian building construction presents a varied picture across subsectors, with anticipated output growth ranging from significantly positive to somewhat negative. Civil engineering is more uniformly positive, but certain sectors show the effects of the completion and commencement of large projects. Both building and civil engineering output growth will be strongly influenced by new government laws and regulations, the consequences of which, while likely to be large, are difficult to predict for both the short and medium terms. These include the new National Housing Policy Plan until 2030, the new tax on real estate and measures to balance the playing field between different types of tourism accommodations.

Despite the rise in investment, Romania will likely continue to see a stifled growth in construction in real terms due to costs remaining high. Stubborn inflation and the slightly disappointing macroeconomic performance combined with increased wages and still high interest rates create a less appealing environment for investors in building construction. On the bright side, high income and imports are indicative of strong demand for consumption and could translate to demand for construction. While infrastructure did well, the current political turmoil and uncertainty could hobble performance going forwards. Even assuming deficit remains high but stable, as the EC expects, it would continue to raise public debt and make financing further projects more politically difficult. As some downside factors could improve by then, construction growth is forecasted to return to positive in 2026.

Serbia’s construction is likely to have closed another strong year led by civil engineering, but non-residential also entered a new growth cycle with positive outlook boosted by public investments and the hosting of the EXPO 2027 in Belgrade. The construction of commercial, office and hotel buildings are all set to grow in the coming period, followed by education and health. Residential construction is already on historically high levels with a relatively stable performance. In civil engineering, road and railway construction continues unabated, breaking new record volumes on the way, but other segments also have an impressive project pipeline. The economy is set to expand by 4% in 2024 and 2025 on the back of strong consumption and high investment, so construction outputs may sustain formidable levels up to 2026.

Slovenia’s construction sector is expected to maintain post-pandemic levels with annual output consistently exceeding EUR 5 billion up to 2026 against the EUR 3 billion pre-pandemic. Public financing has been a key driver with national budget expenditure up from EUR 10 billion in 2019 to over EUR 15 billion in 2024, though there will be spending limits in 2025-2026. Civil engineering in the forecast period will be supported by major infrastructure projects. Residential construction is set to drop slightly first in 2024 before rebounding by 2026 driven by lower mortgage rates. Non-residential construction is forecast to grow steadily but remain dependant on the availability of public financing. Other challenges remain such as labour shortages, permit backlogs and high costs, but construction cost growth is set to stabilize at under 3% annually.

Source of data: EECFA Construction Forecast Report, 2024 Winter

If you would like to receive a sample report please use the following contact button or send an e-mail to sales@proidea.ro

EECFA's Eastern European Region: expansion to continue in Ukrainian construction