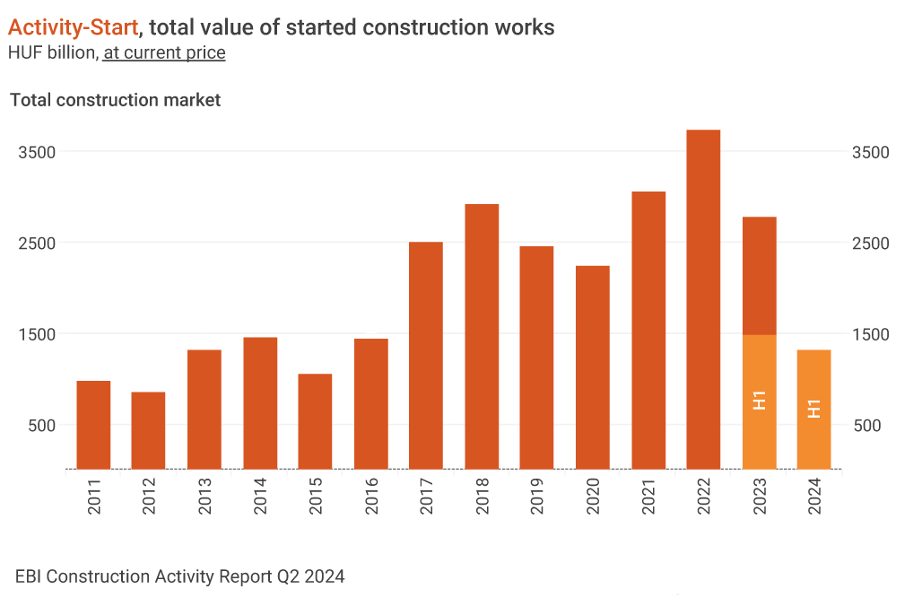

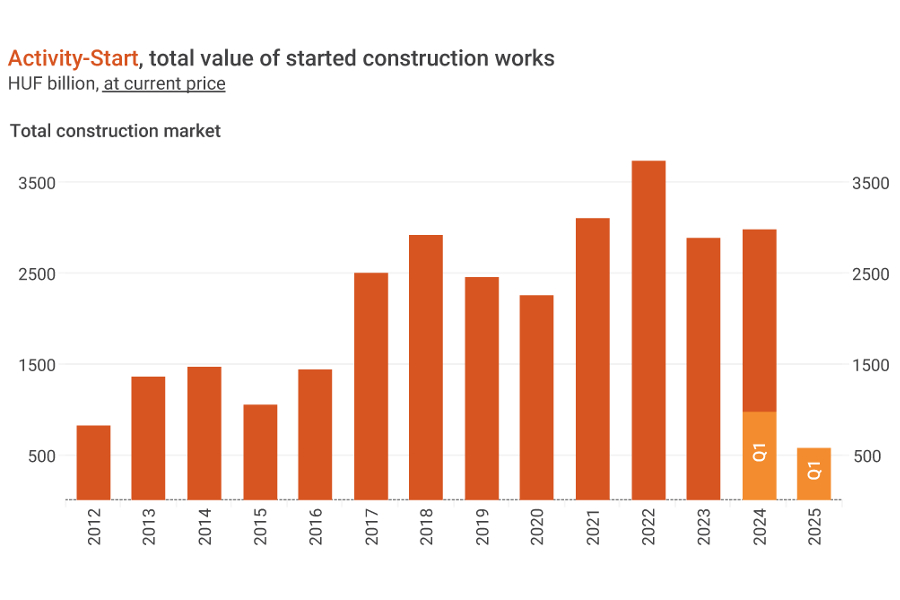

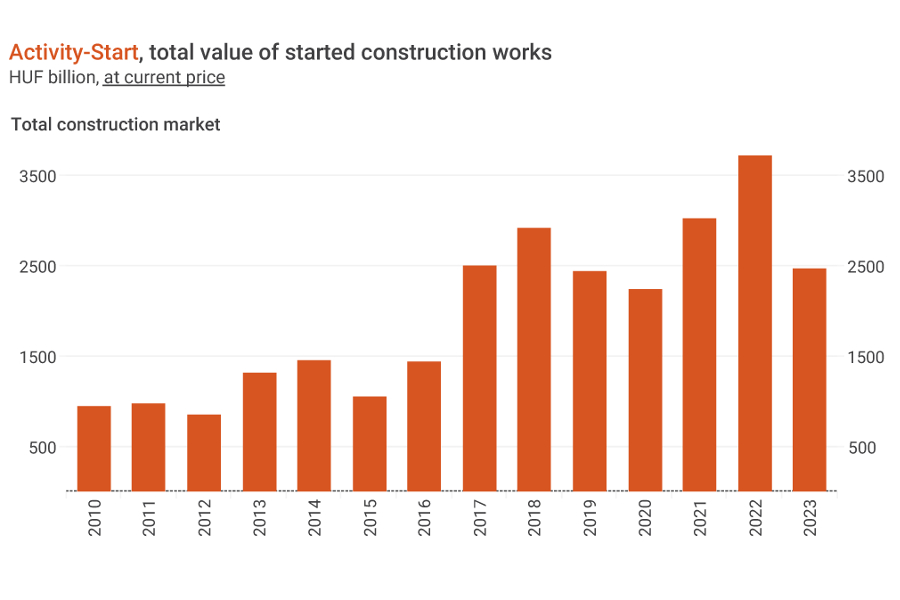

Q2 registers historically low quarterly Activity-Start in Hungarian construction, but H1 is not so bad

As per the latest EBI Construction Activity Report Hungary, in the second quarter this year started construction works barely exceeded HUF 400 billion - the lowest quarterly Activity-Start even at current prices since 2016. But due to the exceptional Q1 value, H1 2024 overall did not show a massive decline (only -11%) over H1 2023. Compared to 2021, however, the drop was 18%, and against the exceptionally good H1 2022, the decline was a whopping 45%. And at constant prices, Activity-Start was the negative record of the past 9 years.

EBI Construction Activity Report Hungary analyses the construction industry on a quarterly basis, including the volume of newly started construction works and the value of projects completed in each quarter in aggregate and by segment as well. It is prepared by Eltinga, Buildecon (creation of indicators and development of algorithms for aggregation) and iBuild (project research and project database).

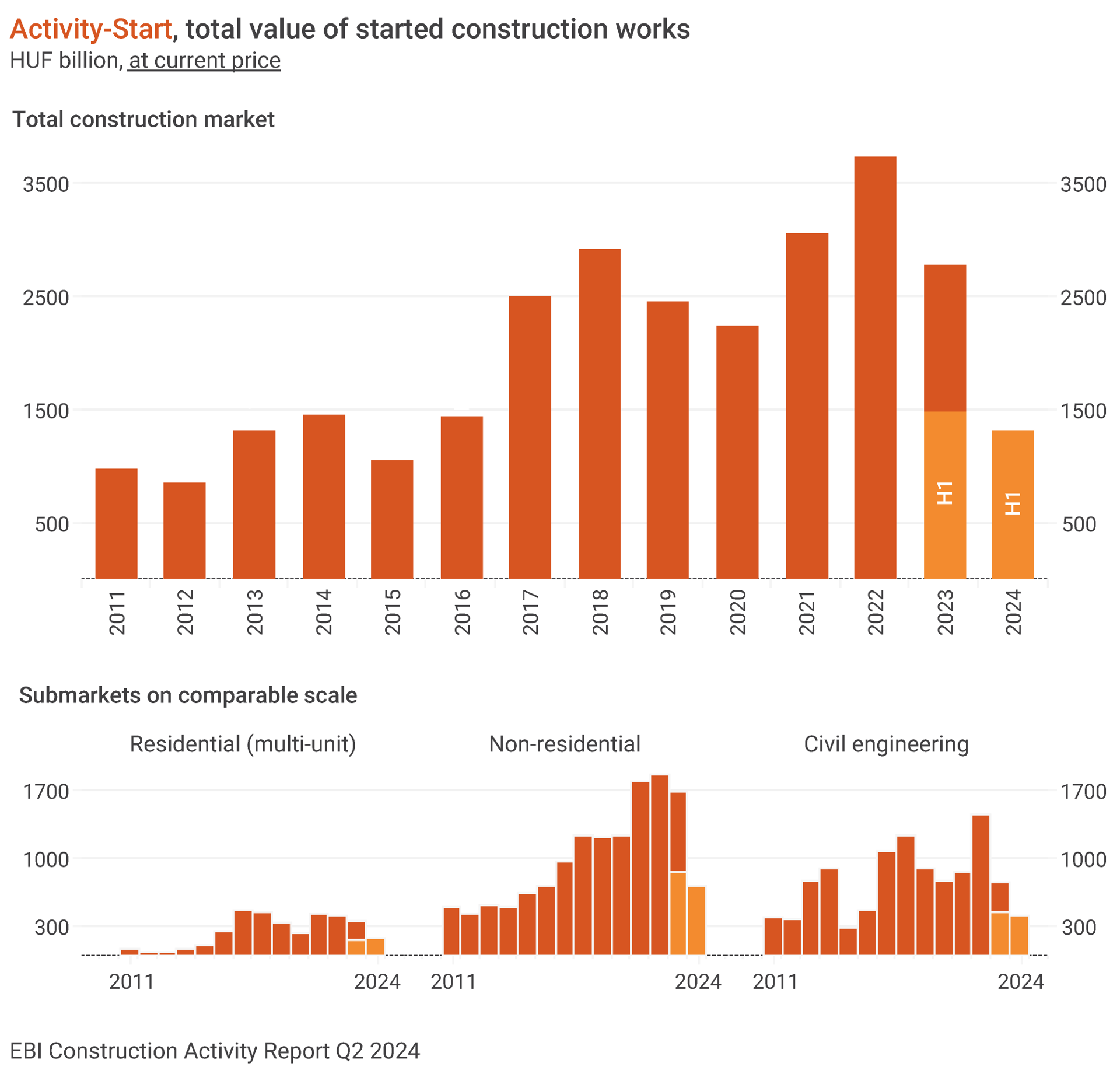

Lowest quarterly value of started building construction works since 2020

As per EBI Construction Activity Report Hungary, Q1 2024 saw a high Activity-Start but was followed by Q2 that recorded a decline in buildings as well. The value of started building construction works did not reach HUF 360 billion - the lowest quarterly figure since 2020.

Overall, the subsector was characterized by a weaker Activity-Start even in the first half of the year: compared to H1 2023, the value of started construction works dropped by 11.8%, while over the same period of 2022 and 2021, at current prices, the decline was almost 30% and 21.5%, respectively. At constant prices, only H1 2014 was weaker than H1 2024.

Most of the decline occurred owing to the more moderate non-residential project starts. The decrease in multi-unit residential buildings was much smaller and the value of started construction works was roughly at the level of Q1. In non-residential buildings, Activity-Start was slightly higher than HUF 260 billion between April and June this year (a drop of almost 43% over Q1) but was also much lower than in the same period of the previous 3 years.

Looking at individual quarters between 2021 and 2023, this year's Q2 was the second lowest at current prices, and at constant prices, it was the lowest value since 2013. Due to the weaker Q2, Activity-Start in H1 2024 was also lower than in the same period of the previous 3 years at current prices. At constant prices, it was only H1 2014 that saw a lower value.

Biggest-league building construction projects launched in Q2 this year comprised the construction of MBH Bank HQ in Budapest, Phase I of BYD electric car factory in Szeged, and Huayou Cobalt-Bamo cathode factory in Ács. The construction of Moxy Budapest Downtown (hotel) and that of several multi-unit residential buildings also began.

The value of civil engineering project starts hit rock bottom in Q2

The stellar numbers in Q1 were followed by a massive decline in Civil Engineering Activity-Start of EBI Construction Activity Report Hungary between April and June this year. Q2 brought minimal civil engineering project starts, and the value of started works did not reach HUF 70 billion - the lowest quarterly value since 2016. However, comparing the first half of the year with previous years, 2024 is not exceptionally bad. The value of Activity-Start was 10.5% and 9% less than in the same period of 2023 and 2021, and it even exceeded that of 2020. There was a major drop only compared to the outstanding figures between January and June 2022. Within civil engineering, in H1 2024 road and railway construction works accounted for around 45% of Activity-Start and their value did not go up to HUF 200 billion.

It is very telling about the rock-bottom level of Civil Engineering Activity-Start that in the period between April and June this year no civil engineering project could make it to the top 10 biggest started construction projects.

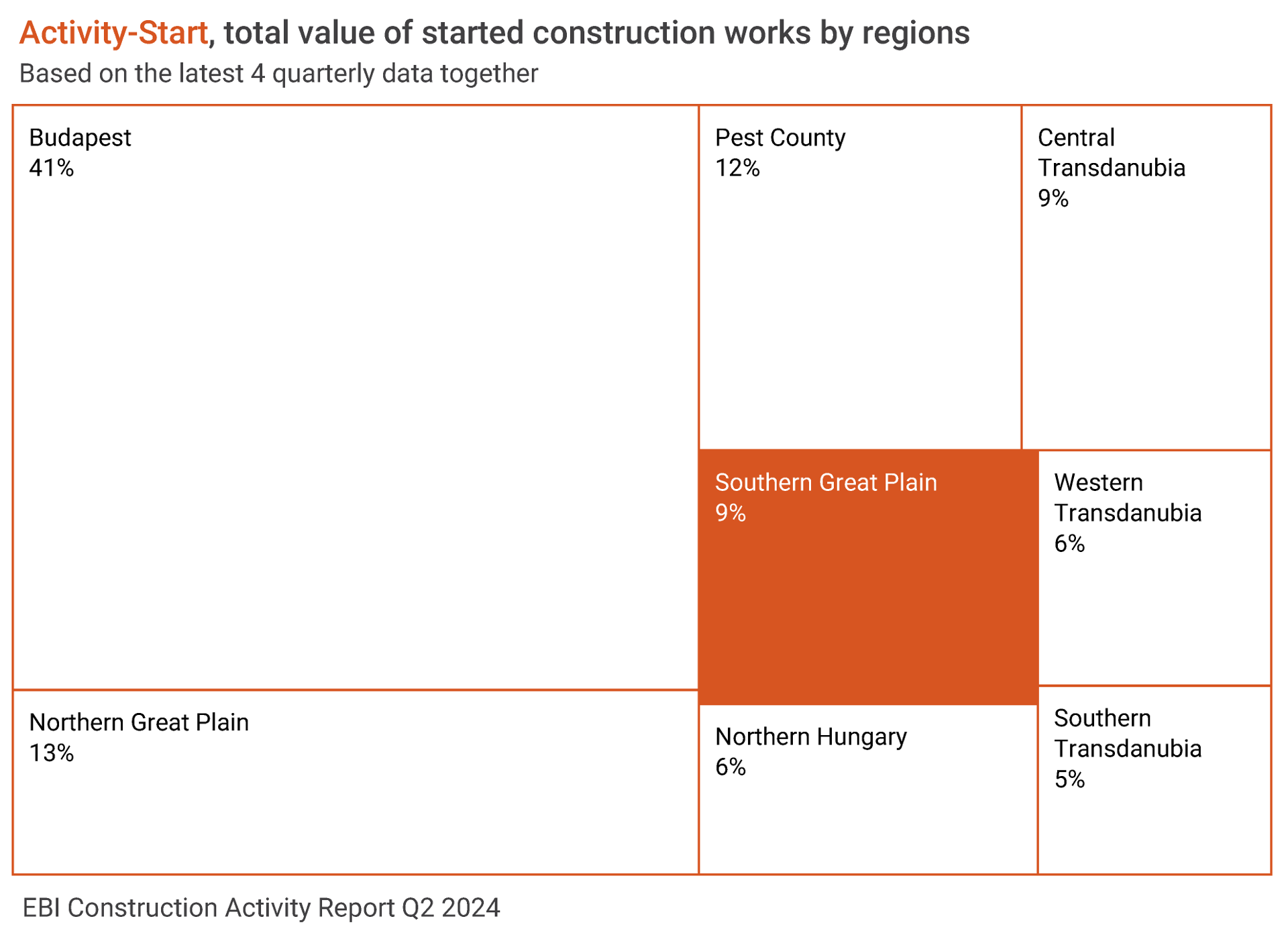

Most construction works continued to start in the capital city

Looking at the past 4 quarters, the largest share of construction works again started in Budapest. The capital city’s share in the nationwide Activity-Start even surpassed 40%.

Northern Great Plain had the second largest share, but its 13% was a great drop compared to the 20%-30% of the previous quarters. Pest County came third with 12%, while the smallest share of projects started in Southern Transdanubia with only 5% of launched construction projects in the last 4 quarters.

Practically no change in the value of started multi-unit residential projects

The latest EBI Construction Activity Report Hungary has found that after Q1 2024, in Q2 the value of multi-unit residential construction works started during 3 months was almost unchanged with a total of slightly more than HUF 90 billion. In the first half of this year, Activity-Start in the segment was less than HUF 200 billion, roughly corresponding to the level of the same period in 2021. At constant prices, although in H1 2024 the Activity-Start of multi-unit residential construction exceeded the one in H1 2023, it fell short of the one registered in the January-June period of previous years. It was only in H1 2015 when it was lower. Nevertheless, compared to other construction segments, multi-unit performed much better in Q2: the 10 largest-scale projects entering construction phase included several multi-unit ones, even with just over 100 flats.

The value of completed multi-unit residential construction works shrank in Q2 against Q1, but it stayed high, outstripping HUF 200 billion in H1 2024, making it the strongest first half year recently. Activity-Completion in H1 2024 was almost 42% higher than in the same period of 2023 and even surpassed the record H1 2020 by more than 22%. Further on, Activity-Completion may continue to be high, and, based on expected completion dates, this year may break a new record.

During the last 4 quarters, the largest share of multi-unit residential construction works continued to start in Budapest whose share also grew compared to the previous quarter with two-thirds of Activity-Start. Eastern Hungary's share was 15.5%, while in Western Hungary 16.6% of such works began.

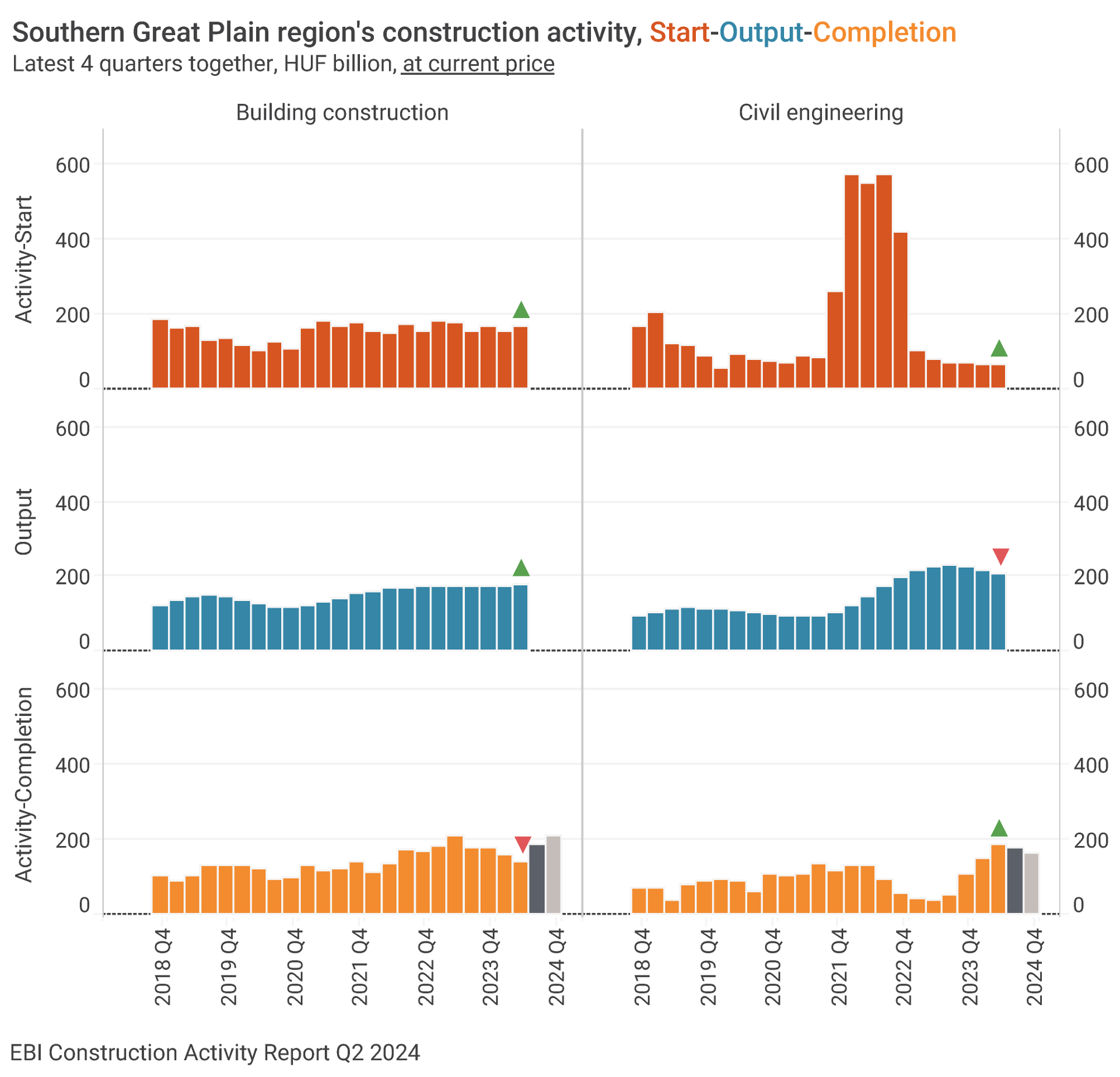

Southern Great Plain saw some growth in half-yearly Activity-Start

Southern Great Plain also saw some expansion in construction during the first half of this year, even though Q2 brought a decrease after Q1 – as per the latest EBI Construction Activity Report Hungary. Activity-Start here amounted to HUF 126 billion between January and June 2024. Building construction projects contributed most to the Activity-Start of this region: the value of started construction works in H1 2024 was HUF 110 billion - the level of H1 2023. But it was also true for regional building constructions that the higher Q1 values pushed up the half-yearly ones and Q2 brought a more moderate Activity-Start. Within buildings, multi-unit residential buildings represented a minimal level in the region, as in previous years, only 6% of such projects nationwide started here in the first half of the year.

Among the biggest non-residential projects entering construction phase in H1 2024 in the region were Benepack’s packaging materials factory in Makó, Mercedes-Benz battery assembly plant in Kecskemét, and Phase I of BYD electric car factory in Szeged. These projects were also considered large in terms of works started in recent years: in value, between 2021 and 2024 they ranked second, third and fifth, respectively.

Hardly any civil engineering project began in Southern Great Plain this year. Activity-Start in civil engineering in H1 2024 was less than HUF 16 billion - one of the lowest half-yearly results in recent years. Civil engineering works in the region reached an outstanding value in late 2021 and in early 2022 that saw the construction start of the Békéscsaba-Lőkösháza railway line, the Soroksár-Kelebia section of the Budapest-Belgrade railway line, and the Kecskemét-Szentkirály section of M44 expressway whose total value was hundreds of billions of Hungarian Forints and whose construction is still ongoing.

EBI Construction Activity Report Q2 2024 has been published and can be purchased at ebi@ibuild.info.