2023: a weak year-end in Hungarian Construction Activity-Start

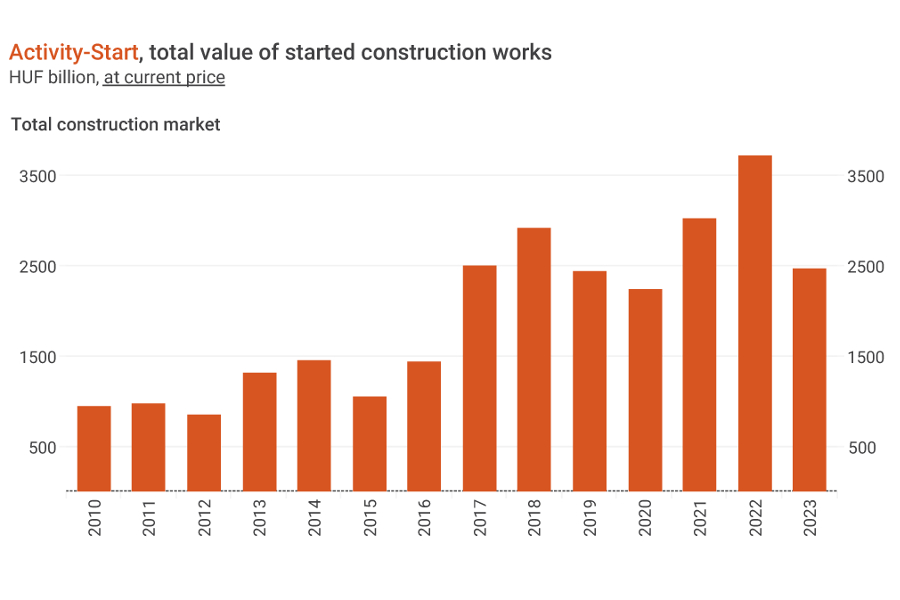

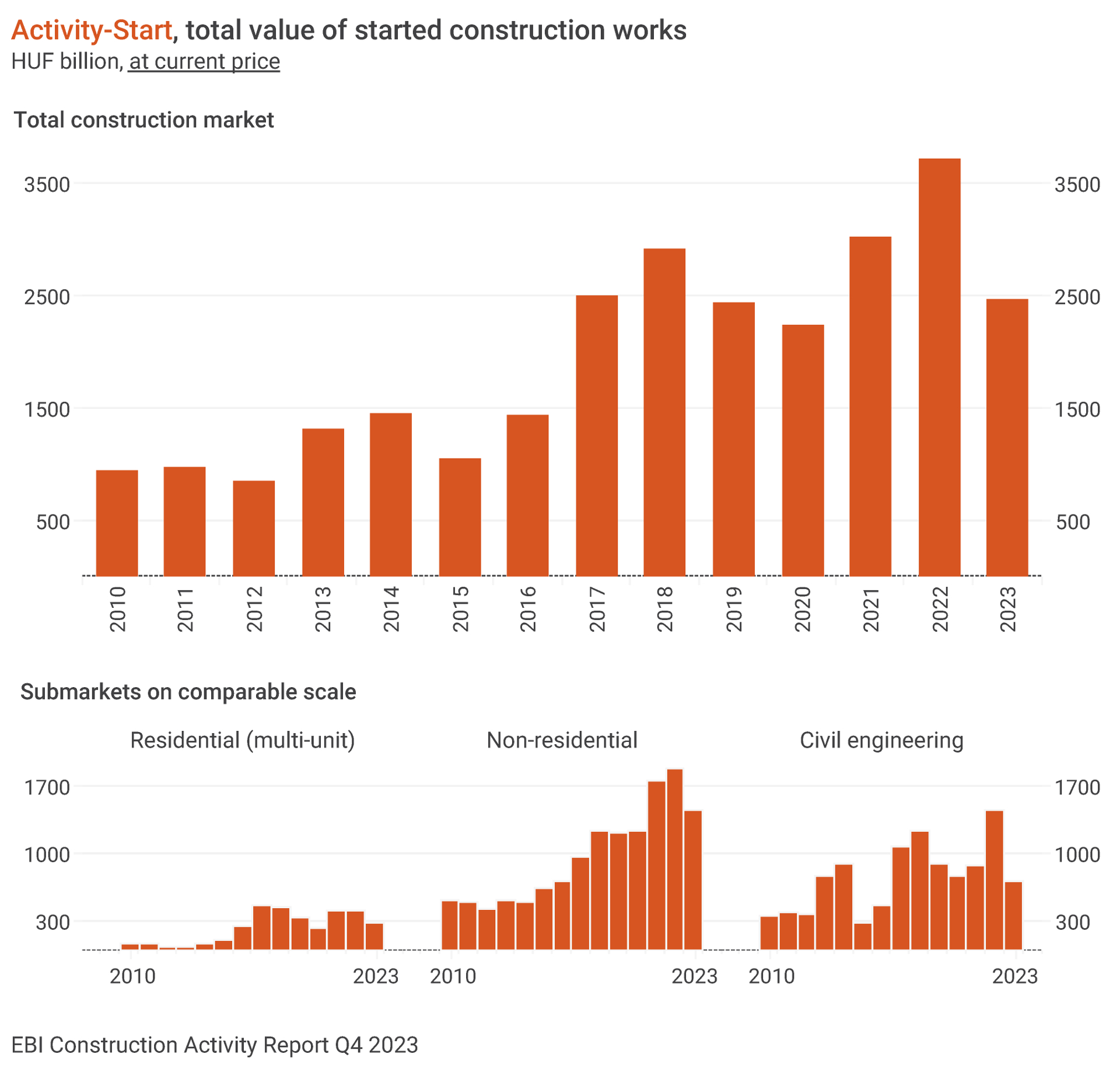

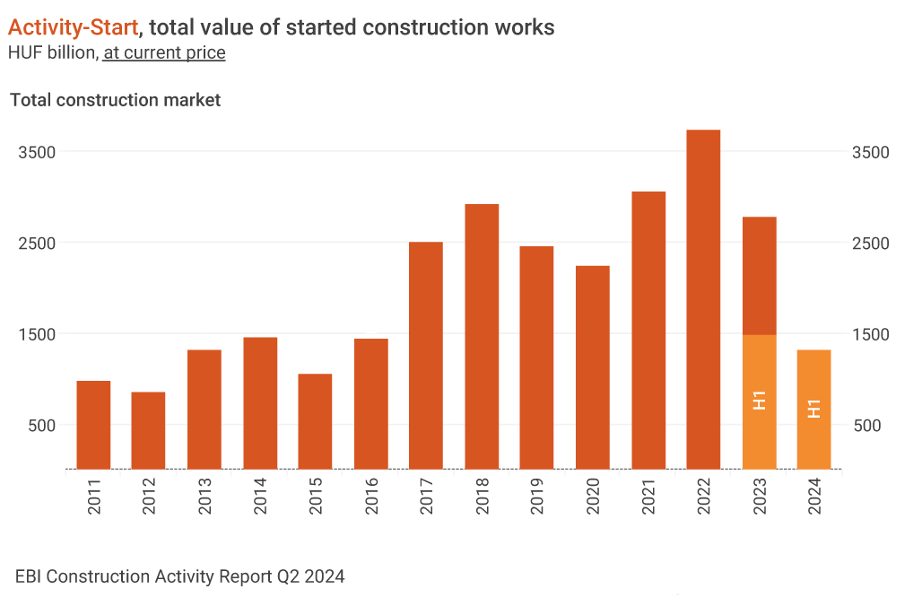

Hungary’s construction sector failed to improve in the last quarter of last year; the total value of started construction works shrank against previous quarters. Overall, 2023 registered low numbers and the Activity-Start indicator of EBI Construction Activity Report did not reach HUF 2,500 billion. This means that the total value of projects entering construction phase dropped by a respective 19% and 34% compared to 2021 and 2022, and Activity-Start in 2023 was roughly the same as in 2019. But if we look at the rate of decrease at constant price, it is even more significant: 43%-44% over 2021-2022. The last time the value of Activity-Start at constant price was lower than last year was in 2015, but even 2013-2014 exceeded last year's.

EBI Construction Activity Report Hungary analyses the construction industry on a quarterly basis, including the volume of newly started construction works and the value of projects completed in each quarter in aggregate and by segment as well. It is prepared by Buildecon, Eltinga (creation of indicators and development of algorithms for aggregation) and iBuild (project research and project database).

Building construction works declined in Q4 2023

Even at current prices, the subsector has not produced such a low quarterly Activity-Start as in October-December 2023. Thus, the lower numbers of the first 9 months did not improve, and for the whole year, building construction works started at less than HUF 1,750 billion: 19% down from 2021 and 23% down from 2022. At constant price, the Activity-Start indicator for 2023 was 44% and 34% lower than in the previous two years. Only 2015 witnessed a lower Activity-Start than 2023.

Within building constructions, Activity-Start decreased in multi-unit residential buildings and in non-residential ones, too. In the latter, Q4 lagged dramatically behind the quarterly numbers of previous years. Last time the value of non-residential buildings entering construction phase in a quarter at current price was lower than that was in 2016. For the whole year, the Activity-Start indicator of non-residential buildings sank by 17% and 22.5%, respectively, over 2021 and 2022. Filtering out the change in prices, the lag is even greater: the level of Activity-Start at constant price in 2023 was 42% and 33% lower than in the previous two years. It was only in 2015 when lower numbers were registered.

The biggest building construction projects launched in Q4 2023 were several logistic facilities and warehouses (HelloParks Páty PT3 logistics hall; Phases 1 and 2 of LG Magna manufacturing plant in Miskolc; ZF Chassis Modules Hungary vehicle assembly plant in Kecskemét; ZF Chassis Modules Hungary manufacturing plant and warehouse in Debrecen). In addition, the project of the Hódmezővásárhely Military Secondary School and Dormitory, the renovation works of the Chemistry building of the Faculty of Science of Debrecen University, as well as Phase 1 of the renovation works of buildings B1, B2 and C of the University of Veterinary Science in Budapest started.

Civil engineering stagnated at a low level

Although there was no further drop in civil engineering, its Activity-Start was very low in Q4 2023 with about the same value of started constructions as in Q3. Thus, Civil Engineering Activity-Start in 2023 massively dropped against 2022 (a year considered an outlier), but the value of the started works did not reach the 2021 level either; and it turned out to be somewhat lower than in 2020. In 2023, there was a 17% drop in the subsector against 2021, and a 50% shrinkage over 2022. The constant-price decrease was even greater: almost 60% over 2022 and more than 40% over 2021. Between 2013 and 2023, at constant price, only the Activity-Start of 2015 was lower than that of 2023.

Hardly any road and railway construction works started in Q4 2023, while much more other civil engineering works entered construction phase. In 2023, road construction works started at a higher value than in 2020-2022, but railway construction works fell greatly last year: here Activity-Start at current price was only lower in 2015. Thus, overall, during the year, the Activity-Start of road and railway constructions was around 19% lower than in 2021, while it was almost 60% less than in 2022 (a year considered outstanding).

The largest civil engineering projects in Q4 2023 were mostly related to water and sewerage in Tolna and Bács-Kiskun counties, in Adony and Ercs regions, in Tamási and vicinity, in Várpalota and vicinity, as well as in Csemő, Cibakháza, Nagykőrös, Tiszafüred, Jászszentandrás, Tápiószőlős and Kengyel.

Most project starts are still in Eastern Hungary

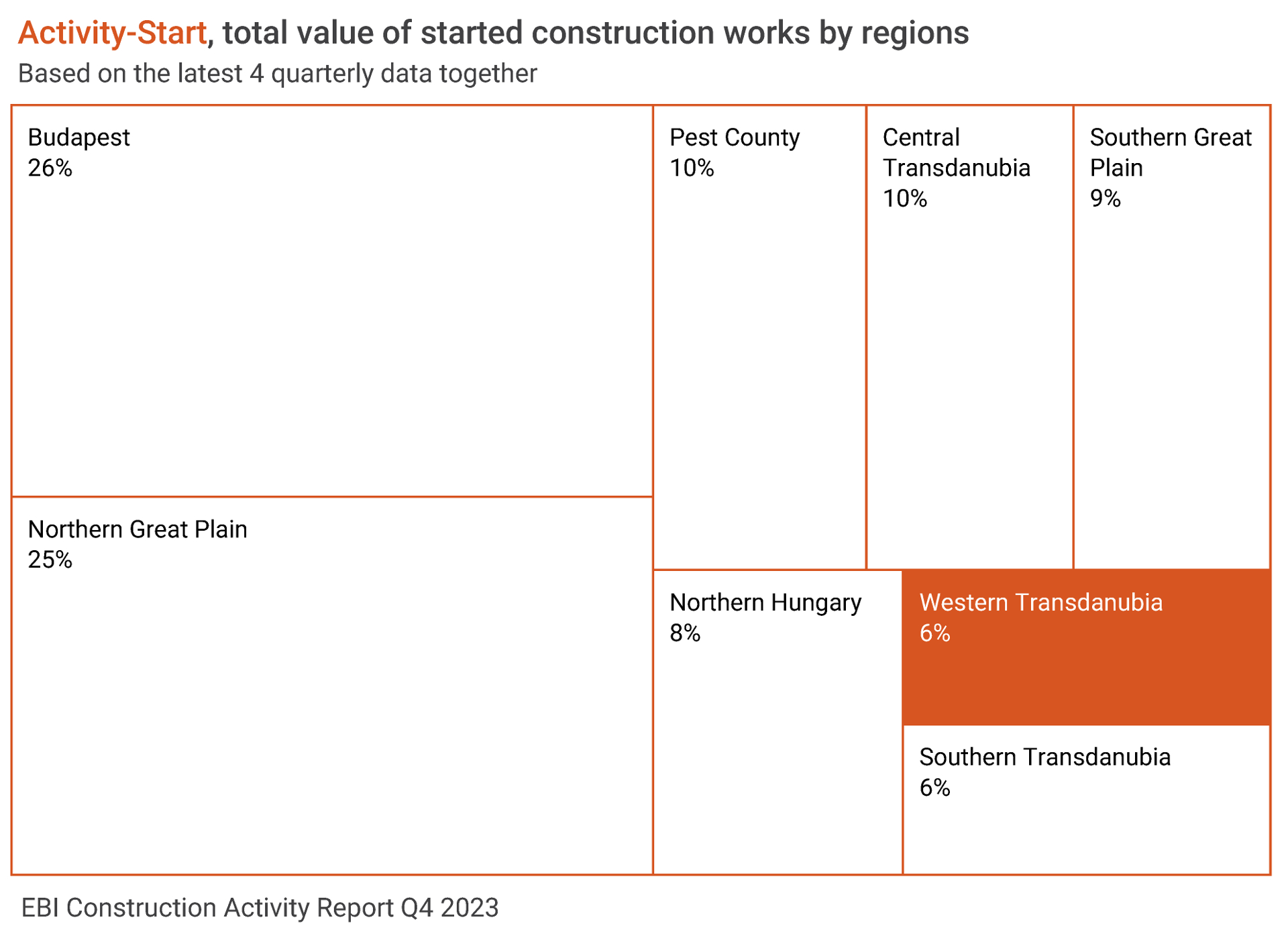

In the past four quarters the biggest share of construction projects started in Eastern Hungary with the region’s share in Activity-Start being 42%. Budapest accounted for 26% of the value of projects entering construction phase. After Budapest, Northern Great Plain had the second highest share, 25%, followed by Central Transdanubia and Pest County with 10% alike. In the last 4 quarters, 21.5% of construction works started in Western Hungary, and 36% in Central Hungary.

Sunk interest in building multi-unit homes

After the promising numbers of Q2 and Q3 last year, there was another decrease in the Activity-Start indicator of multi-unit residential buildings. During the whole 2023, the value of such started constructions did not reach HUF 300 billion (-28% against 2022 and -30% against 2021). If we look at the period of 2017-2022, it only exceeded the level of 2020, however, at constant prices, the value was lower in 2023 than in 2020 (a year when the pandemic hit and VAT on new residential units was set back to 27% from 5%). It was only in 2015 when the value of started multi-unit residential constructions was lower. Compared to 2022, at constant prices, the decrease was 38%, and compared to 2021, it was more than 50%, as per the latest EBI Construction Activity Report.

This year brought major changes in state subsidies for home purchases. From 1 January, in cities only those planning to have additional children can receive CSOK+. Those who do not have additional children are only eligible for the village CSOK in beneficiary settlements. The so-called Baby Loan, although it remains available for married couples having a child, have more stringent rules. The new CSOK+ does not include a direct non-refundable support at the time of purchase, a bigger discounted loan can be applied for, and non-refundable support can only be obtained upon the birth of the 2nd and 3rd children when part of the outstanding debt is released. The new system does not differentiate between the purchase of used and new homes, making the previous advantage of new homes disappear. In addition, in case of CSOK+, one can no longer use VAT refund when buying a new home.

On a positive note, the money to be claimed has been raised, so it can be of great help in case of higher-priced new homes. Also, this year interest rates on market loans have greatly decreased compared to the beginning of last year, and it is expected to continue, so demand may recover in the new market, which may also improve the prospects of developers, encouraging the start of more projects this year than last.

In 2023 the value of Activity-Completion indicator in multi-unit housing exceeded HUF 350 billion, representing an increase of almost 28% compared to 2022, and surpassing the level of 2021 by 23%. This year also expects to see high numbers.

Although the biggest share of such constructions still started in Budapest, the capital city’s share in Activity-Start in 2023 slightly dropped over 2022. In total, around 60% of constructions started in Central Hungary, slightly more than 15% in Eastern Hungary, while the share of Western Hungary was a bit over 24%.

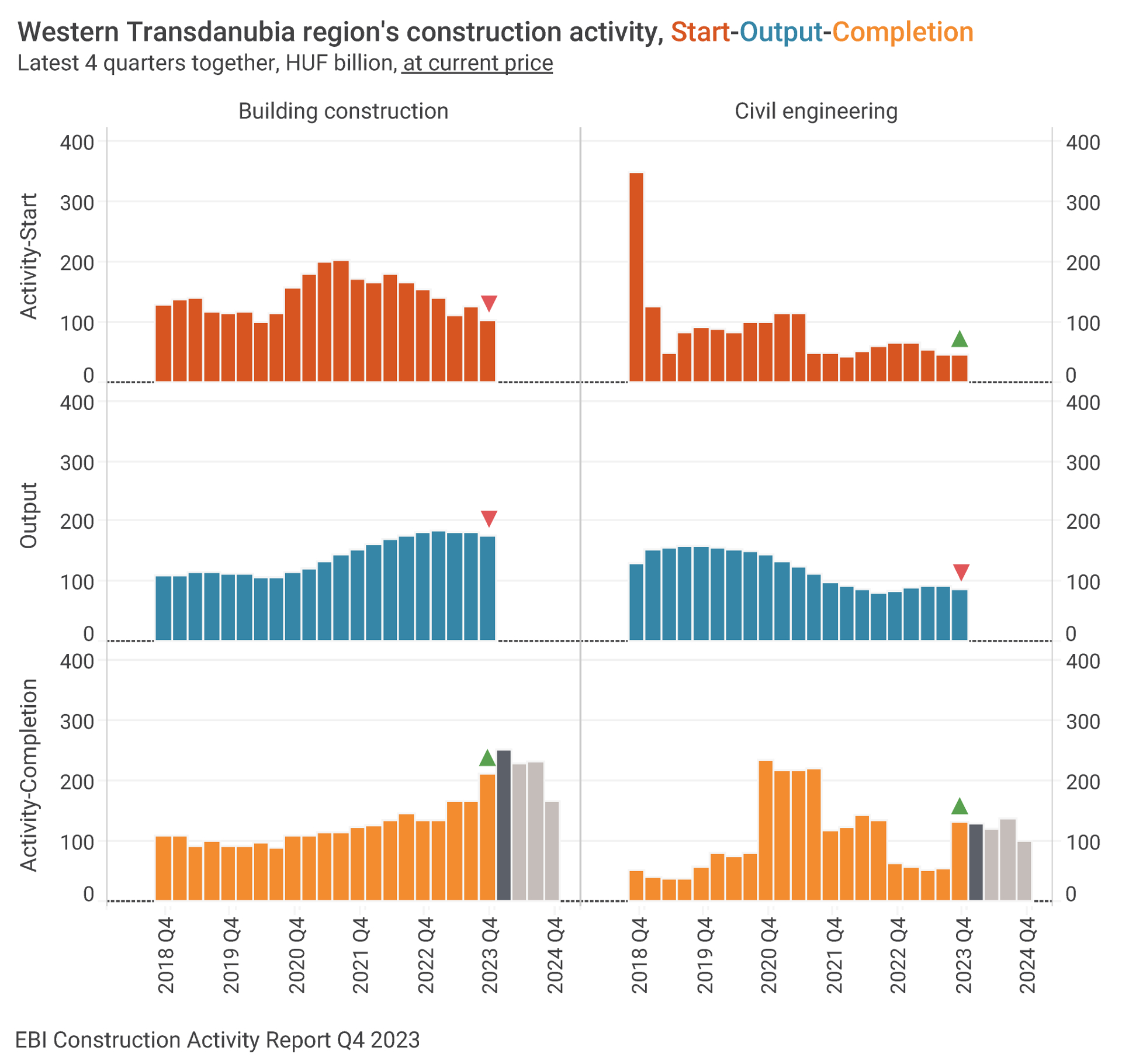

Western Transdanubia

Last year around 6% of started construction works concentrated in the Western Transdanubia region, the same as in 2022. Although due to the declining Activity-Start countrywide this meant a much lower value of started constructions than the year before, the drop was 34%. In 2023 Activity-Start in the region was lower than in previous years (-34% compared to 2021 and almost -44% below the 2020 value). The previous peak in the region was in 2018 when several large-scale projects were launched: M85 highway, M8 highway, and the section of main road 76 between M7 highway and Keszthely, and a stretch of M15 highway between M1 and Rajka.

The value of started building constructions in Western Transdanubia shrank last year; over 2022 there was a 34% drop, while compared to 2021 the decrease was 41%. The projects launched in 2023 included warehouses and factories, for example, the Nestlé Purina pet food production plant and warehouse in Bük or the Velux GP4 production hall in Fertőszentmiklós.

Civil engineering works were also at a low level in 2023 (-32% against 2022, but only an 8% drop compared to 2021). In 2023, only one regional civil engineering project made it to the larger projects; Phase 3 of the Zalaegerszeg vehicle test track. The last time a hike was registered in civil engineering was in 2018 thanks to large road projects.

Recent years have seen a declining Activity-Start in building construction works in Western Transdanubia. At the same time, Activity-Completion has exhibited growth; for instance, 2023 was a record year for the value of completed building construction projects. Projects that reached completion last year comprised several plants of Nestlé Purina, the Water Adventure Park in Győr, Sirius Hotel in Keszthely, and Buildings A1, A2, A3 of VGP Park Győr Béta.

Original article: Tünde Tancsics, ELTINGA - English version: Eszter Falucskai, Buildecon

EBI Construction Activity Report Q4 2023 has been published and can be purchased at ebi@ibuild.info.