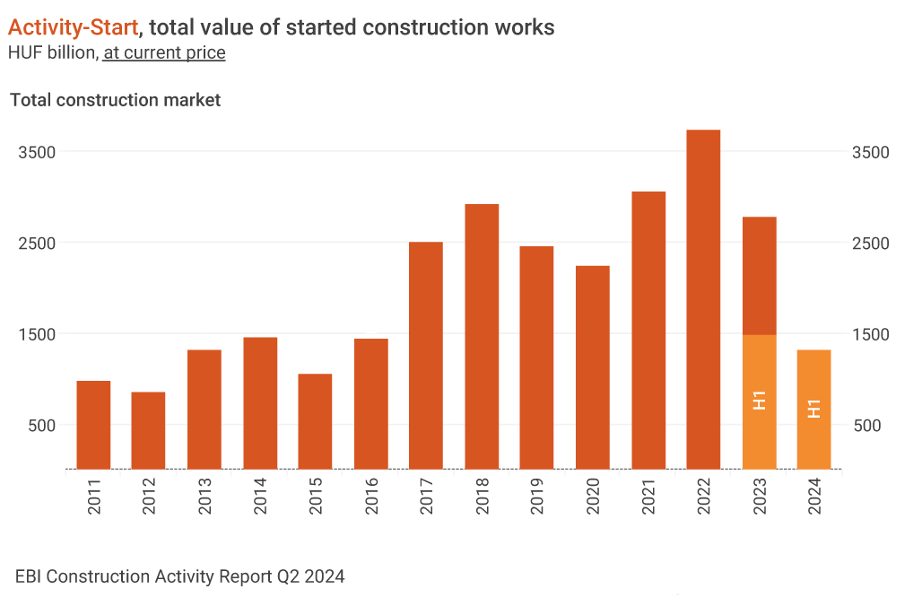

Value of started projects between January and September almost 17% down y-o-y

According to the latest EBI Construction Activity Report Hungary, after Q2 brought a decline in the value of started construction projects, in Q3 a further decrease followed.

Since 2016, the Activity-Start of less than HUF 360 bln between July and September 2024 has been a new negative record, even at current price. These weak numbers were not even offset by the better Q1 and Activity-Start accounted for slightly more than HUF 1800 bln. The value of projects entering construction between January and September 2024 was almost 17% lower than in the same period of 2023.

EBI Construction Activity Report Hungary analyses the construction industry on a quarterly basis, including the volume of newly started construction works and the value of projects completed in each quarter in aggregate and by segment as well. It is prepared by Eltinga, Buildecon (creation of indicators and development of algorithms for aggregation) and iBuild (project research and project database).

Shrinking Building Construction Activity-Start

Q3 saw a continued decline in Building Construction Activity-Start with only HUF 310 bln worth of started works. Except for the pandemic year of 2020, only 2017 and earlier years saw lower quarterly numbers. Looking at the first 9 months of this year, the value of started construction works was slightly less than HUF 1360 bln, 15%-22% lower than in the same period of 2021-2023. At constant price, the drop was even more considerable: since 2014 there has not been a lower Activity-Start in the first three quarters than this year.

Multi-unit housing constructions posted a slight decrease in Activity-Start in Q3, but non-residential projects registered a larger drop with only HUF 200 bln worth of projects entering construction phase between July and September. In the first 9 months, the Activity-Start of non-residential constructions was around HUF 1000 bln, 21%-27% lower at current price than in the same period of 2021-2023. At constant price, the last time the number for the first three quarters was lower than this year’s was in 2014.

The largest construction projects launched between July and September 2024 included Lidl's logistics center in Kiskunfélegyháza, HelloParks Páty PT5 logistics hall, Pick's production plant in Szeged, Intretech's plant in Kapuvár, Rheinmetall's hydrogen and e-mobility parts production plant in Szeged and IGPark's logistics hall in Debrecen. The construction of the hotel in Kígyó Street in Budapest also started. Out of the 10 biggest projects in the quarter, 5 were multi-unit residential buildings or dormitories.

Civil engineering Activity-Start hits rock bottom

There was a further decline in civil engineering after Q2, Activity-Start in Q3 was only less than HUF 50 bln – a new negative record of the last 8 years. But in terms of Activity-Start in the first 9 months, the 2024 result is not much better either. The value of construction works started in the first three quarters at current price has not been lower than this year since 2016, while at constant price it was the negative peak of the last 10 years.

Compared to the same period in 2021 and 2023, Activity-Start between January and September this year was 22%-24% lower, while it was only a little more than a third of the exceptionally high 2022.

Within civil engineering, only a negligible railway construction project started in Q3, and the value of road construction projects was also very low. In the first three quarters, road and railway construction accounted for roughly 45% in Activity-Start, their value slightly exceeding HUF 200 bln.

Due to the rather low civil engineering activity, hardly any civil engineering project could get into the list of biggest projects. Only the wastewater projects in Dejtár agglomeration and the Rétság agglomeration are worth mentioning.

Budapest leads still

Looking at the last 4 quarters, 39% of all started construction works were in Budapest. The second largest Activity-Start was characterized by the Northern Great Plain (14%), followed by the Southern Great Plain and Pest County (12%). Northern Hungary and Southern Transdanubia recorded the lowest value of started construction works with their respective share of around 5%.

Multi-unit construction works are keeping up

Even though somewhat fewer multi-unit housing constructions started in Q3 than in Q2, Activity-Start significantly exceeded Q1. Construction works started in the segment on slightly more than HUF 100 bln. Looking at the first 9 months of the year, there was an overall higher Activity-Start at current price than in the same period of 2019-2023. The value of projects entering construction was roughly the same as in the same period of 2022. At constant price, the Activity-Start for the first 9 months of this year outstripped the first three quarters of 2023; yet it was the second lowest since 2016.

This suggests that developers are still cautious with project starts even though this year's demand for new homes increased compared to last year’s. Based on housing market trends, supply is expected to grow. A strengthening demand and rising prices may encourage more investors to start projects, and thus Activity-Start in multi-unit construction works may also increase in the future.

In Q3 the value of completed multi-unit housing buildings continued to drop, barely surpassing HUF 60 bln. At the same time, in the first 9 months, approximately HUF 265 bln worth of such buildings were completed, a slight rise over the same period last year. For the time being, a larger volume of homes is expected to reach completion in the last quarter, however, due to project delays, some may only be completed next year.

The biggest share of multi-unit residential constructions still started in Budapest. Based on the data of the last 4 quarters, the share of the capital city was around 60%. Eastern Hungary accounted for 14% of the Activity-Start, while Western Hungary for 24.5%, up from the previous quarters.

Central Transdanubia

Activity-Start in Central Transdanubia was roughly HUF 40 bln in all three quarters this year.

Thus, in the first 9 months, construction projects started at a total of HUF 123 bln, a major drop compared to the same period of previous years. In the first 3 quarters of 2023, Activity-Start in the region was almost HUF 200 bln, while in the first 3 quarters of 2022, it reached around HUF 300 bln.

After the weaker Q1, Activity-Start for building constructions in Central Transdanubia in Q2-Q3 was roughly at last year's levels. Thus, overall, the value of projects entering construction was around HUF 100 bln in the first 9 months of this year, lower than in the corresponding period in 2023, and particularly lower than in the same period of 2021-2022.

The outstanding building construction Activity of 2021-2022 was boosted by the start of several big-league projects in 2021 (SK On's battery factory in Iváncsa, Alba Aréna multifunctional hall in Székesfehérvár) and in 2022 (Kovács Katalin National Kayak-Canoe Sports Academy, the renovation of the church buildings in the castle quarter of Veszprém).

Projects entering construction phase between January and September 2024 in the region included the Huayou Cobalt-Bamo cathode factory in Ács and Phase 3 of Campus Lane Condo in Székesfehérvár.

In the first 9 months of 2024, hardly any civil engineering projects started in Central Transdanubia and the value of started works only reached a bit more than HUF 20 bln.

Among major civil engineering projects this year only Phase 1 of the dam between Mária-Valéria Bridge and Prímás island ramp can be mentioned. Last year bigger-value civil engineering projects started in the region in Q3 and Q4, for example, several water utility or wastewater projects, and the Biatorbágy-Szárliget railway line.

Original article: Tünde Tancsics (ELTINGA);

English version: Eszter Falucskai (Buildecon).

EBI Construction Activity Report Q3 2024 has been published and can be purchased at ebi@ibuild.info.