Written by Dr. Sebastian Sipos-Gug - Ebuild Srl, EECFA Romania

Reading the recent blog post regarding permit and completion data one can see that the trend for residential permits in Romania seems to have taken a downturn since 2021, and this naturally raises the questions: What has happened? Has the market peaked or is it just a temporary setback?

The supply-side story

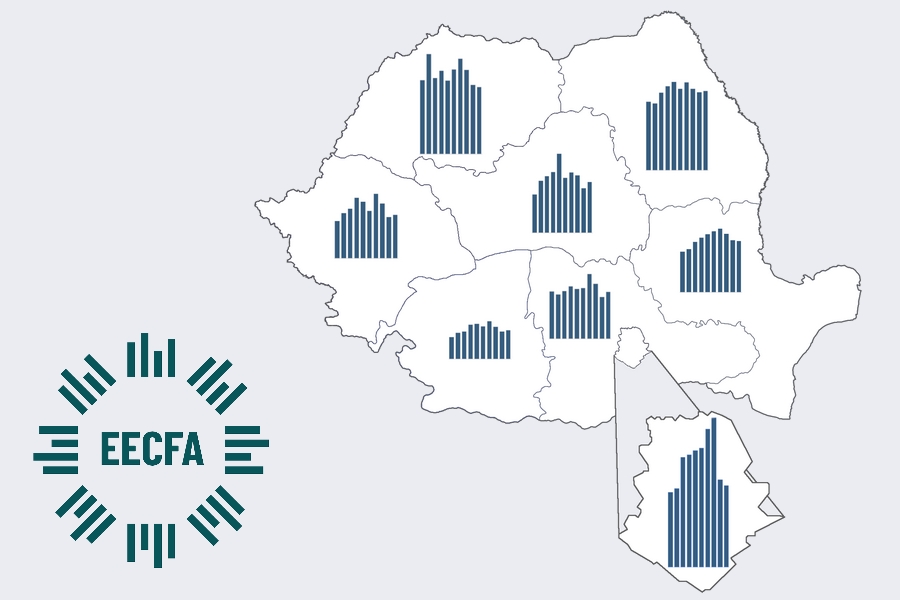

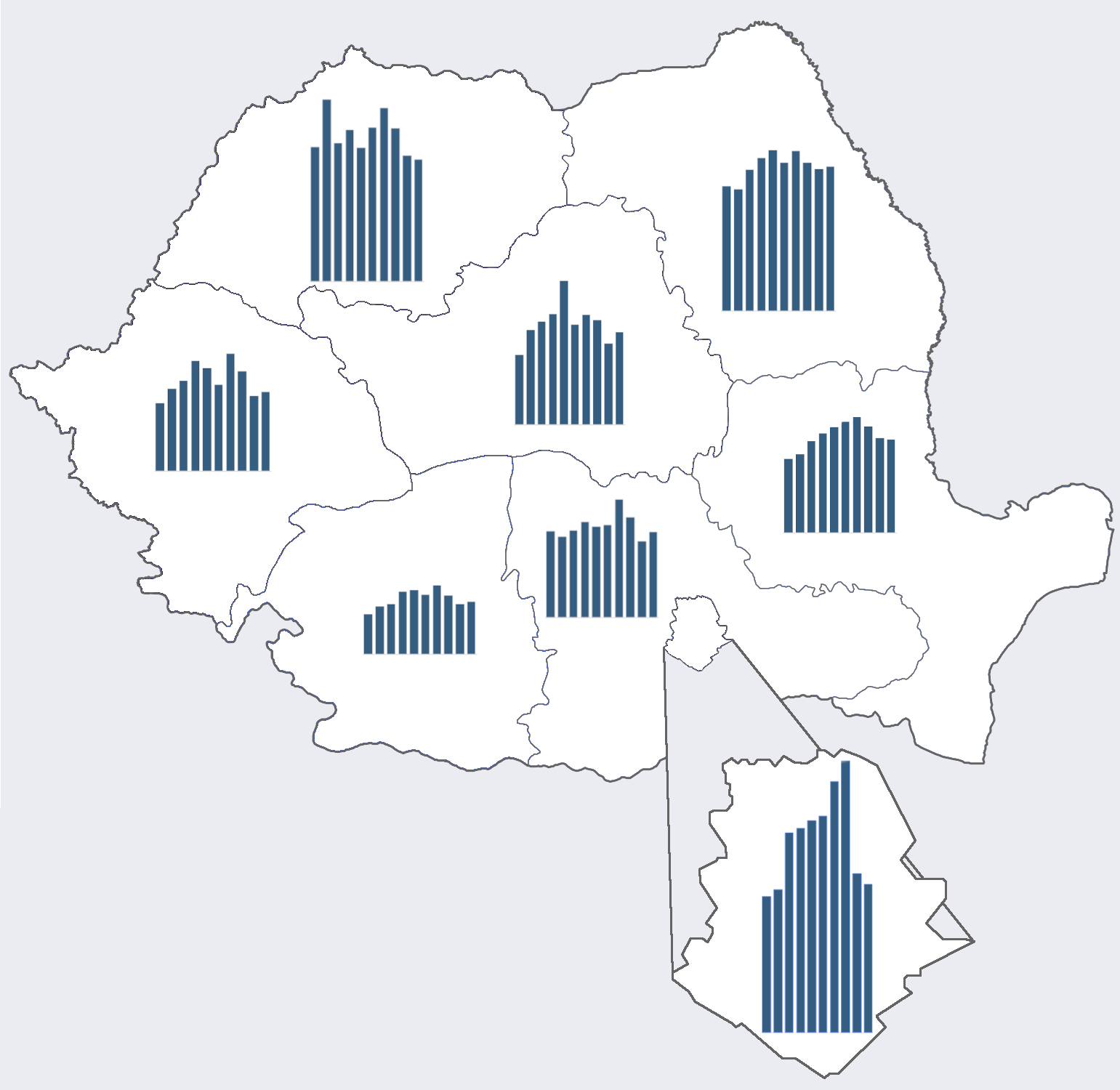

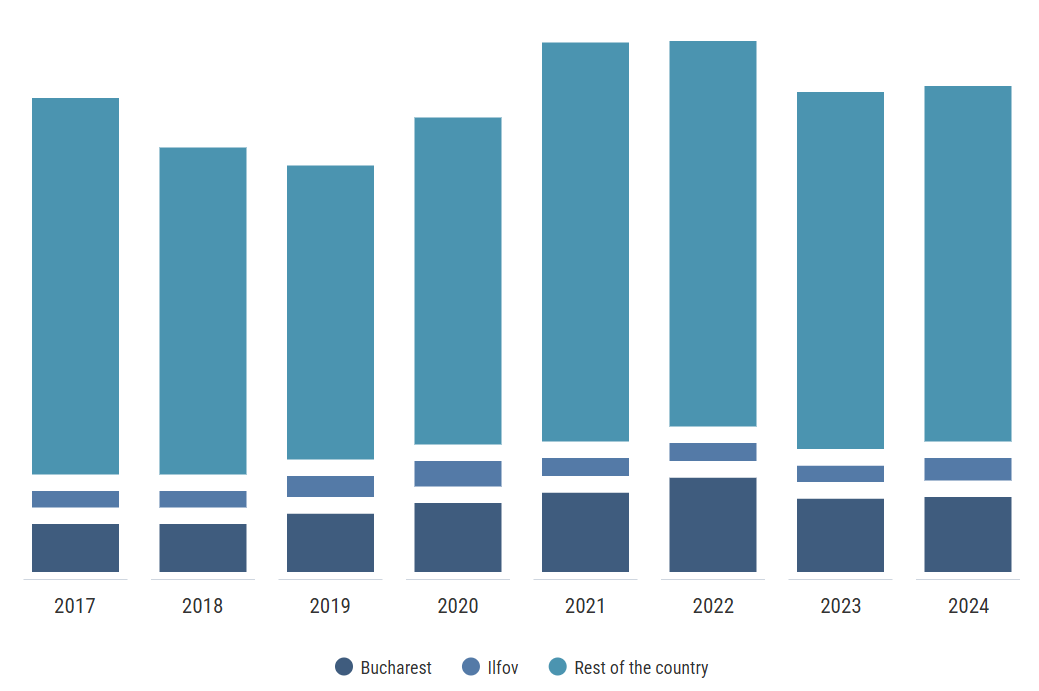

In order to attempt answering these questions, Dr. Sebastian Sipos-Gug, EECFA’s researcher on Romania, started by looking at permit data for a longer period and split by regions. The slowdown in 2023 and 2024 was present in most regions, but none of them was hit as hard as Bucharest where the useful area in residential permits nearly halved in 2024 compared to the peak of 2022. Thus, whatever effect led to the drop in permits, it disproportionally affected Bucharest. While it remains by far the most active region, the drop is oversized when adjusted for its share of the market.

In case of Bucharest, a non-trivial amount of this effect could be explained by the gridlock in the urban planning area, with permits for all types of construction hindered by the cancellation in 2022 of the existing zoning plans which have yet to be replaced by newer versions. This makes it more difficult to gain permits for new developments, and could be, at least partly responsible, for the observed shrinkage in residential permits in the last two years.

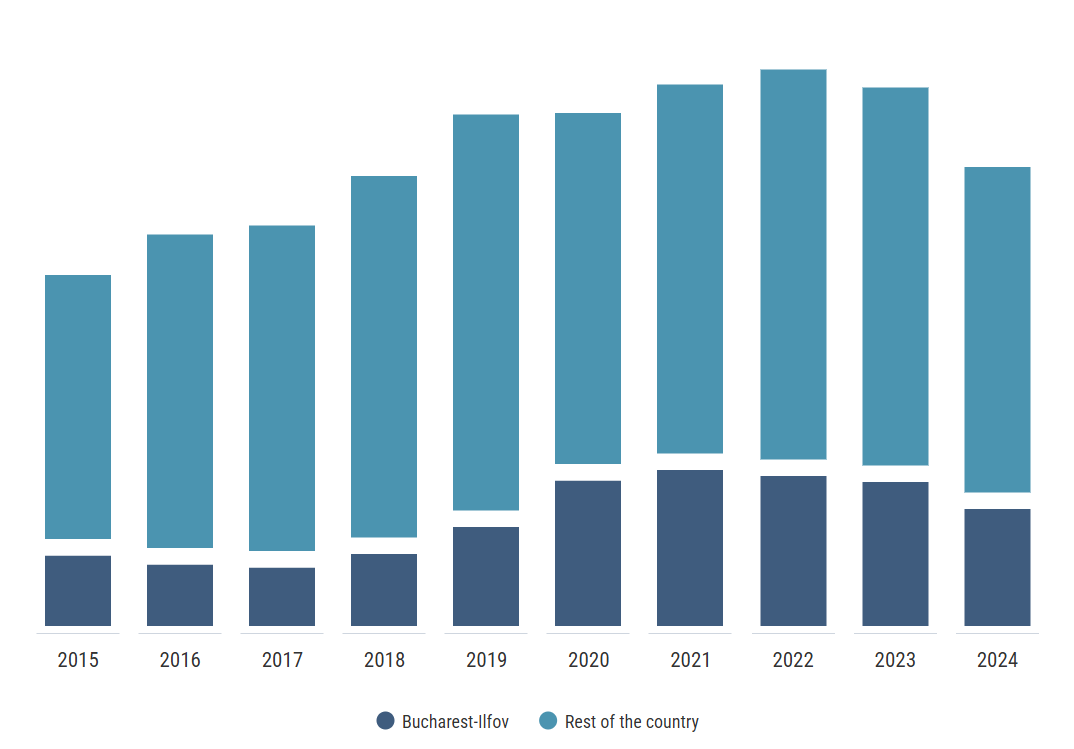

The next logical step seemed to be looking at other indicators such as completions and seeing what happened there. Indeed, they have also been on the decline with the number of completed homes country-wide in 2024 being comparable to that of 2018. Again, Bucharest-Ilfov saw a much larger drop in 2024 over the 2021 figures, standing at –33% compared to –12% in the rest of the country.

The decline is quite apparent in the supply of new housing overall, but that the situation is much more dire in Bucharest.

The demand-side story

Could the decrease in supply be a response to lower demand? After all, if developers have difficulties selling stock, they are unlikely to start new projects.

Looking at the number of transactions, they indeed declined overall in 2024 compared to the peak of 2021, but the effect was much smaller with just around 10% fewer properties being sold in the whole country, while in the Bucharest-Ilfov region there was barely any change (-0.3%).

At the same time, prices of homes continued growing, but this time Bucharest (+20%) lagged behind the country (+27%), meaning that the price gap between the capital and the rest of the country is slowly closing.

However, when comparing the growth in home prices to that of the rise in construction costs, the situation looks more dire. As of 2024, residential construction costs grew 41% over the 2021 level, far outpacing the increase in prices. This was partly due to increased materials costs (+32%), but also due to much higher labor costs (+60%) for construction workers. Since in January 2025 tax breaks for construction workers were eliminated and the minimum wage for them grew, it's unlikely for the situation to improve in the short term, potentially discouraging developers from new investments until prices reach a place where they offset the costs and offer similar margins as before.

What does this mean for housing affordability?

This topic was touched upon last year, in another blogpost, with the conclusion that it is useful to look at affordability from two standpoints: cash buyers and mortgage takers, since increased interest rates can negate the effects of wage growth.

Taking a regional split into account this time, it’s noticeable, and perhaps slightly surprising that homes are more affordable in Bucharest as the wage gap between it and the country average is higher than the residential prices gap.

This took a turn, however, in 2024 as home affordability in Bucharest started to drop, while the national average remained more or less the same. If the previously mentioned issues that limit permitting are not resolved, we can expect this trend to continue in the future as well since a limited supply will mean higher prices.

Another factor that could limit future supply, at a national level, is developer funding. It used to be the case that developers would focus on presales and use very high downpayments in the project phase (up to 90% in some cases) to fund the construction work, without requiring a bank loan.

Since a high-profile scandal regarding a large developer brought this issue into the limelight, confidence in this type of arrangement has declined and buyers are less likely to accept paying high downpayments before construction has even started. Concurrently, there is a bill underway aiming to limit downpayments for unfinished buildings to 10%. Should developers resort to banking loans for their projects, it would make the market more stable but more expensive for them, leading to either lower margins, or higher prices.

When it comes to home affordability for those using a mortgage loan, things are not looking better than they did last year. Inflation has proved to be stickier than expected, and the Central Bank is lowering reference interest rates slowly, meaning mortgages will continue to be relatively expensive in the near future.

While the higher wages in the capital again prove to be an advantage, making homes slightly more affordable than for the average Romanian, this indicator was also on the decline in 2024 for Bucharest, and stable for the rest, shrinking the gap between the two.

In the context of high energy costs, in 2021 construction costs increased. Since then, the situation has not improved dramatically, and it’s unlikely to change in the near future as inflation and high wage growth will keep an upwards pressure on them in 2025 as well.

Bucharest is doubly feeling the pain when it comes to new residential development. Adding to high construction costs, there are issues with urban zoning and permits approvals. The supply constraints mean higher prices, leading to slightly declining home affordability, especially for those relying on mortgages.