Written by Dr. Sebastian Sipos-Gug - Ebuild Srl, EECFA Romania

Dr. Sebastian Sipos-Gug, EECFA’s researcher on Romania, visited the affordability of homes several times in the past as an argument for market stability and to counter doomsayers. Last time he did so, however, he wrote that the residential market was approaching a turning point. And last year, despite decelerating growth in average home prices, the hike in interest rates made housing less affordable for those resorting to a mortgage loan. In case of cash buyers, on the other hand, affordability grew to historically high levels.

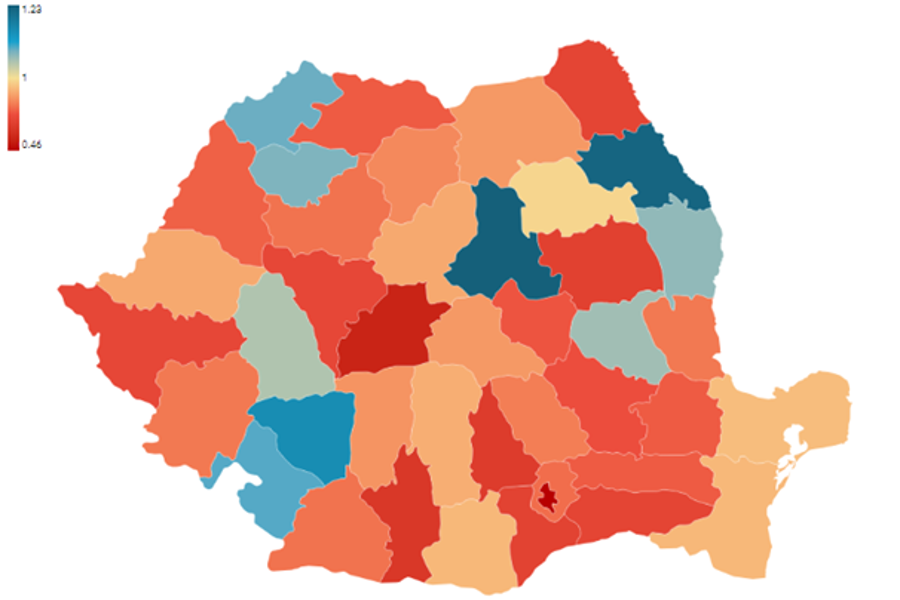

While official output data is lagging a couple of years, some indicators are painting a less optimistic picture. For instance, permits for homes dropped massively in 2023 like-for-like (-24%) and real-estate transactions also declined (-10%). Decline in the useful area in permits for residential buildings seems to be a national issue since only a handful of counties saw an increase in the useful area permitted, while the usual drivers of growth (Bucharest, Center and West regions) were in the red. This does not mean construction will necessarily decline since the permits issued in 2021 and 2022 were at historically high levels, but it does put a cap on the growth potential of the market.

EECFA looked at these figures in more detail and provided forecast up to 2025 in the latest EECFA Forecast Report.

Housing affordability: a key indicator of the stability of the residential real estate market.

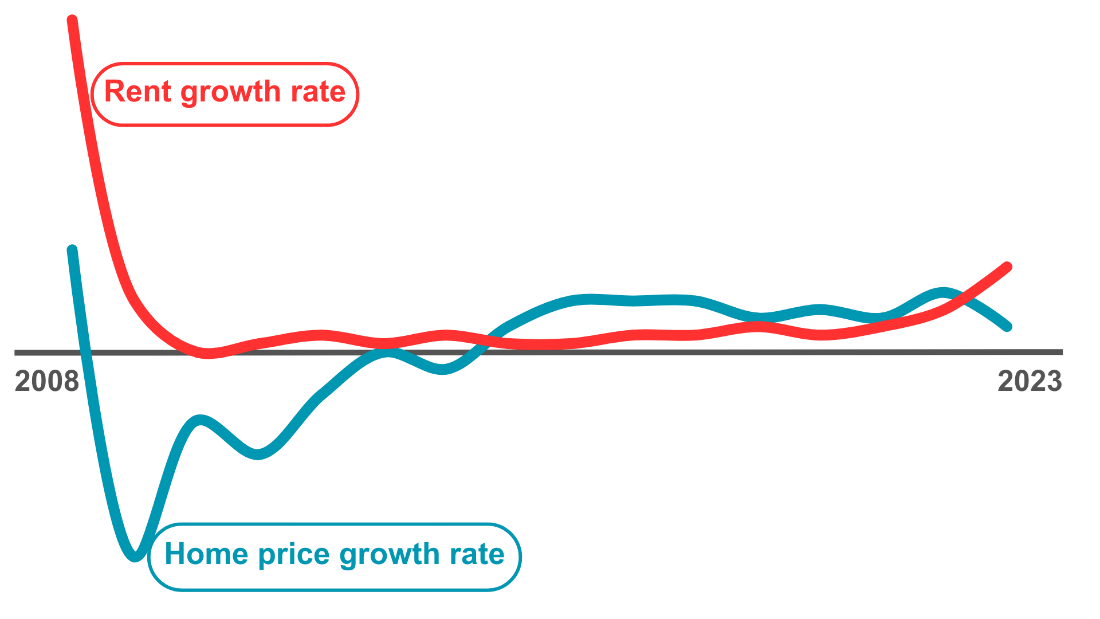

Housing affordability can signal potential issues in the near future such as right before the market crashed in 2008 one could see that prices became disconnected from income, pointing to a speculative market. Decreasing home affordability can also have a negative impact on economic growth as it diminishes the available share of income that can be used for optional purchases.

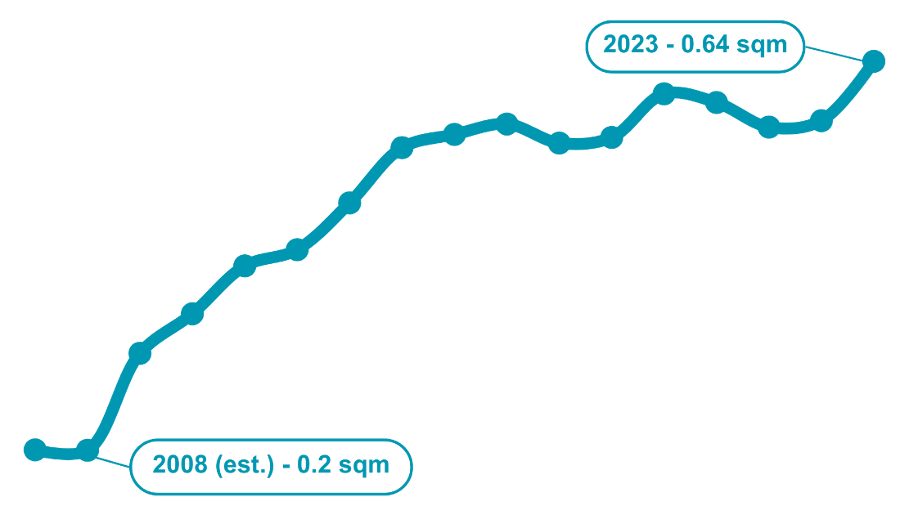

A commonly used indicator of housing affordability is the time it would take to purchase a 70 sqm home with the average monthly gross wage. While this indicator has merits in allowing international comparisons, it is preferable to look at net wages instead as fiscal changes in 2018 (moving tax burden from employers to employees) would have otherwise distorted the indicator by introducing a break in time series.

Homes were getting more and more affordable for cash buyers as prices grew more slowly than wages in most years from 2009 onwards. However, this simple model fails to explain all of the data. If it were true that more people could afford homes, we should see a surge in purchases. If not enough homes were for sale, prices would rise quickly.

Since we are not seeing either, one needs to assume that some other factor is at play here. A potential solution to this conundrum lies in the fact that cash transactions are estimated to account for slightly more than half of all transactions, with the remainder being funded by mortgage loans.

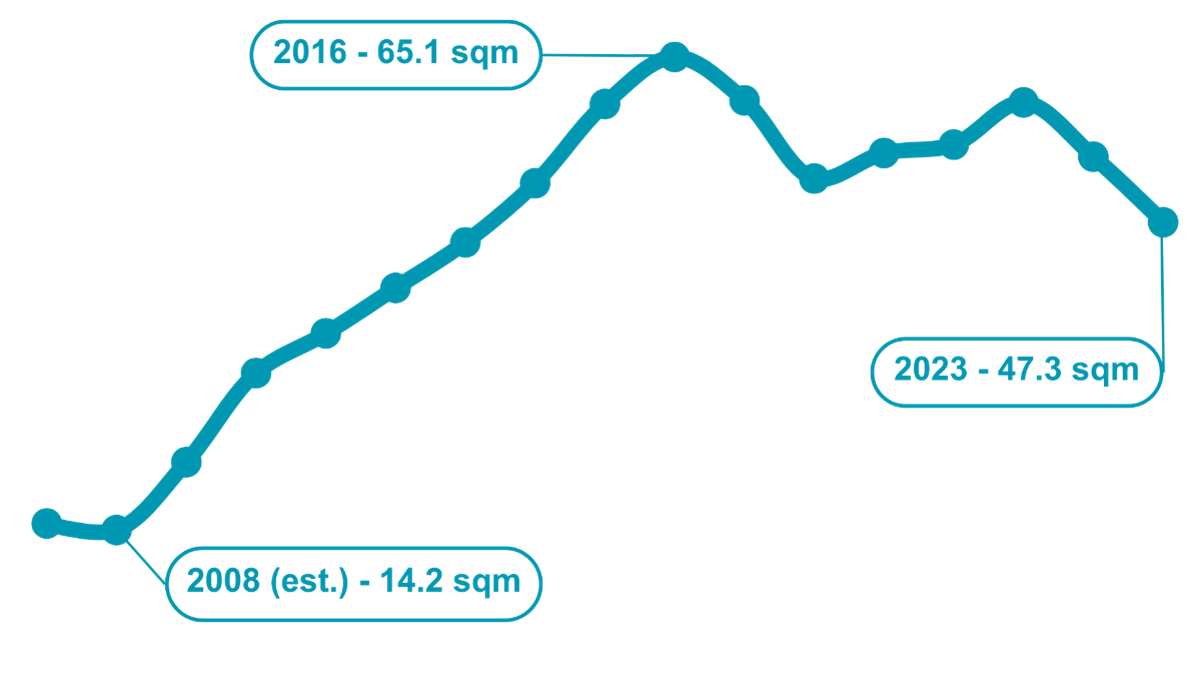

Accounting for mortgage loans, however, requires some assumptions to be made. Namely, purchasing a home with a mortgage loan that has a 25% downpayment, a 30-year loan term, an average interest rate for the respective year and no additional costs, and a debt-to-income ratio of 40% of the national average net wage (currently the legal maximum with some exceptions).

This shows the impact that increasing interest rates to combat inflation has had on housing affordability. While in 2021 the average individual could purchase an average home (under the previous assumptions) of 60 sqm, by 2023 this had declined to 47 sqm, meaning that for borrowers homes are the least affordable in the last decade.

What’s in store for the future?

From what we see, the major trends with impact on home affordability are somewhat optimistic:

- Interest rates are to drop as the National Bank is set to reduce reference rates once inflation comes down. With current national and EC forecasts placing inflation within the target range by 2025-2026, a gradual reduction is expected in the reference rates by then (a positive impact on mortgage affordability).

- Income growth rate has outperformed the increase in home prices in all but two years since 2008. With a robust labor market and a modest but positive outlook of the economy, wages are set to keep growing in real terms in the near future.

- Rentals are an increasing alternative to purchasing a home. Traditionally, Romania has one of the highest home ownership rates in the EU (97.7% at the time of the 2011 census), but the recent uptick in rents signals a rise in demand for housing, so this warrants closer monitoring. Depending on the availability of supply, this could mean more transactions or a higher price point since a share of current renters will consider converting to a mortgage, should it be more affordable.

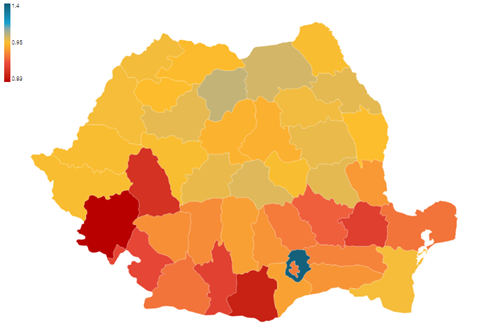

- Demography is on the decline. The overall population shrank by more than 5.3% between the two censuses of 2021 and 2011, especially in the southern part of Romania (apart from Ilfov). This should, in theory, make housing more affordable, but the demographic decline is most prevalent in less desirable rural areas, so the impact might be minimal.

If left unchecked, the combination of these two trends (housing is less affordable for mortgage borrowers, but housing affordability for cash buyers is record high), could lead to increased wealth inequality in longer term. For now, they seem to cancel each other out and demand is somewhat mollified. Nonetheless, Romania remains above the EU average in terms of housing affordability, and, assuming no unexpected changes in market dynamics, it is predicted to improve in the near future as inflation and interest rates come down.

EECFA (Eastern European Construction Forecasting Association) conducts research on the construction markets of 8 Eastern-European countries, including Romania.